Stripe is a company that provides a way for individuals and businesses to accept payments over the Internet through their Stripe Payments interface.

It is providing an alternative to Paypal and other online payment systems and while quite new is being quite aggressive in its marketing and compatibility within other systems.

The beauty is that you can now use both Paypal and Stripe Payments and pick up more customers as Stripe allows for direct Credit Card Payments with none of the hassels that Paypal provides. It also works cross platform and cross device so you can use it to collect payments on mobiles and tablets.

Stripe Payments VS Paypal

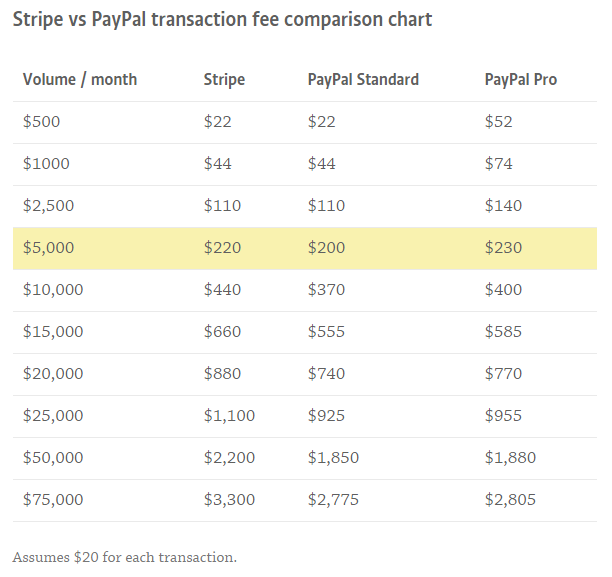

As you can see, $5,000 in monthly volume is an interesting data point. That’s right around where it starts becoming cheaper to use PayPal. Keep in mind, we’re not counting any of the service fees we discussed earlier, which would bring the PayPal costs up a bit.

When do I get paid?

PayPal usually pays out within 1 business day, while Stripe Payments takes 7 full days. If fast access to your funds is important, keep this in mind.

Update: USA Stripe customers now get faster two day transfers.

Security

Both Stripe Payments and PayPal take security seriously. At the core, they’re both very stable and secure platforms. Let’s talk about how they’re different, and how Stripe Payments intrinsically encourages good security.

Stripe’s killer feature when they first launched was Stripe.js. When you use Stripe.js on your website, the credit card data entered into your payment form is never sent to your server. Instead, the data is sent directly to Stripe. Why is this so important?

- Automatically PCI compliant because you don’t handle any sensitive credit card data on your servers.

- More secure because a breach of your servers won’t result in any stolen credit card data.

- You’re not tempted to store credit card data on your servers, which you really shouldn’t be doing unless you’re a big business and want to pay for PCI compliance.

If you follow the normal flow with Stripe Payments, you’ll just automatically store your cards in their vault. You’ll never touch the sensitive data. Thisencourages good security.

PayPal now has a way to store cards in a vault, but it isn’t quite the same as Stripe.js. The sensitive card data has to go through your servers, and this puts a big security burden (see PCI compliance above) on the software developer or the customer who has installed the software.

In summary, Stripe.js encourages good developer security practices, while PayPal gives developers room to make bad decisions. They’ve recently taken steps to provide better options, but these options still aren’t as secure as Stripe.js.

Stripe Payments in Other Programs

As stripe Payments grabs traction we see it popping up in many different programs.

I did an article a while ago re online accounting and telling you how I moved to a free accounting system called Wavapps and how we used stripe to collect payments. You can read the article here.

We have also incorporated in our Woo Commerce store where we sell a range of digital products. You can View the site here.

Plus you can get a number of plugins for your own site that allow you to use Stripe Payments for your payments.

Important Note: It is always suggested that when allowing people to enter their Credit Cards on your site that you use a good SSL Certificate and you can pick them up quite cheaply. To do this with a normal back will take hours and all sorts of fees an paperwork.

Stripe Payments For eCommerce

Irish co-founder John Collison, 24, says Stripe payments is aimed at helping businesses, particularly online start-ups, to quickly set up a way to get paid and will cut out the need for extra staff to maintain banking and payment relationships.

“It allows people to start accepting payments from anyone anywhere in their particular currency,” he says. “Online businesses are very fast moving and the last thing they have time for is to spend time setting up payments.”

Stripe Payments provides a “tech platform that businesses can build on”, giving the merchant a set of “application user interfaces”. Once incorporated into the businesses’ websites, these automatically set up the necessary links to payment options and to the merchants’ bank accounts, according to Collison.

Stripe Payments says it is now being used in 17 countries and is processing “billions of dollars” every year.

It will cost businesses 1.75 per cent plus 30¢ of each domestic transaction, and 2.90 per cent plus 30¢ for international and American Express transactions.